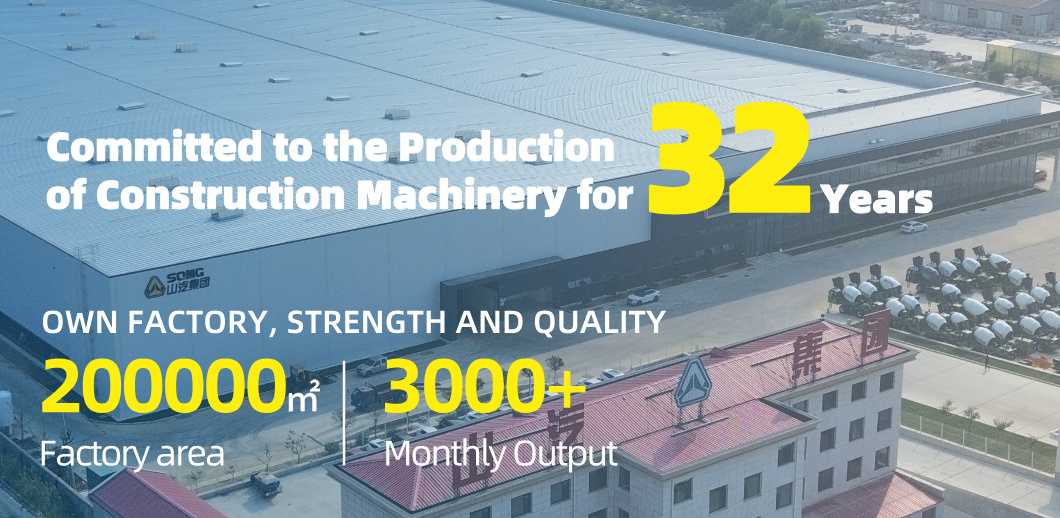

Three Decades of Industry Evolution and Trusted Expertise

The Growth of Heavy Equipment Manufacturing Since the 1990s

The heavy equipment manufacturing sector has seen massive growth worldwide over the past few decades, expanding around 72% since 1995 thanks largely to booming infrastructure projects and advances in precision engineering. When manufacturers started moving away from old school analog systems back in the late 90s, they brought in real time load monitoring capabilities and set up standard safety measures such as ISO 3449 standards. According to OSHA data from 2022, this transition actually cut down on worksite deaths by about one third. These days, the roughly $186 billion industry is all about modular design approaches where parts like hydraulic cylinders can get upgraded without needing to replace whole machines, saving both money and downtime for operators across construction sites everywhere.

How Long-Term Experience Builds Manufacturer Credibility

With 85% of construction firms requiring a minimum 15-year operational history from equipment partners (KHL Group 2023), manufacturers with multi-decade experience demonstrate unique advantages:

- 30% lower failure rates in weld joints from optimized production workflows

- 12% faster customization turnaround through archived engineering templates

- Lifetime cost savings averaging $740k per bulldozer (Ponemon 2023)

Case Study: Lessons from Industry Leaders

One major player in construction equipment managed to get their fleet running almost all the time, hitting around 97% uptime thanks to these fancy digital twin simulations that basically copy how machines wear down in the real world. When they tested their hydraulic excavators under stress, they found something pretty important: those big boom arms were bending about 3mm after working nonstop for nearly two years straight. This discovery is shaping what alloys will be used in future models. On another front, a company from Japan figured out a clever way to cut down on waiting times for parts. By setting up partnerships across different regions and creating local warehouses, they shaved off almost three weeks from delivery schedules, making things run much smoother for customers throughout Asia.

Market Trends Driving Demand in Construction Equipment

The $2.3 trillion global infrastructure push (GlobalData 2025) requires machinery balancing emissions compliance with durability:

| Trend | Impact on Manufacturing | Example Adoption |

|---|---|---|

| Electric Powertrains | 47% R&D budget increase | 350-ton excavators |

| AI-Driven QA | 62% defect reduction | Robotic weld cells |

| Circular Components | 81% part reusability | Remanufactured gears |

| Urbanization projects now account for 68% of global equipment sales, with 78% of firms prioritizing suppliers offering 15+ year lifecycle support. |

Engineering Reliability: Designing Durable and Fail-Safe Machinery

Common Failure Points in Heavy Machinery and Design Responses

According to Reliability.com from last year, about 43% of unexpected downtime in heavy machinery comes down to three main issues: hydraulic leaks, structural fatigue problems, and worn out bearings. To tackle this mess, manufacturers have started using something called FMEA analysis when they design prototypes. Basically, they look at which parts are most likely to fail and either duplicate them or upgrade materials. Take excavators for instance. Many companies have switched from regular carbon steel to stronger alloy steel for their boom structures. Field tests show this change makes the equipment last around 60% longer before showing signs of fatigue, especially important in tough mining conditions where machines work non-stop day after day.

Industry Standards for Manufacturing System and Hardware Reliability

ISO 12100 and ANSI/ASSP Z590.3 define baseline requirements for safety-critical systems like braking and load-bearing structures. Leading manufacturers exceed these standards by implementing design-for-reliability (DFR) protocols, which involve:

- 3D stress simulation during CAD modeling

- Component-level accelerated life testing

- Real-world vibration spectrum replication in QA labs

Case Study: Predictive Maintenance and Digital Twins at Komatsu

A leading manufacturer reduced excavator transmission failures by 82% after deploying sensor-driven digital twins. By cross-referencing real-time torque data with 20+ years of historical failure patterns, engineers optimized maintenance intervals and redesigned gear tooth profiles to eliminate stress concentrations.

Balancing Cost Efficiency with Long-Term Equipment Durability

While high-grade materials increase upfront costs by 12–18%, lifecycle analysis shows they lower total ownership costs by 34% over 15-year horizons. Advanced coating technologies demonstrate this balance—thermal-sprayed ceramic coatings add $1,200 per engine block but prevent $9,800 in rebuild costs from cylinder wear.

Digital Transformation Reshaping Heavy Equipment Manufacturing

The Rise of Smart, Technology-Driven Production Systems

The latest wave of heavy equipment manufacturing is making good use of IoT systems which cut down on unexpected downtime by about 23% according to some recent McKinsey research from last year. Smart AI programs are crunching massive amounts of data from operations to fine tune how things get made on the factory floor. At the same time, engineers all around the world can work together much better thanks to these cloud-based tools. What makes all this tech so valuable? Well, it tackles those frustrating problems manufacturers face daily such as when parts don't arrive on time or when products come out with defects that need fixing before shipping.

Integrating Automation, Robotics, and Additive Manufacturing

Manufacturers who have adopted collaborative robots report about 18 percent improvement in their assembly speeds when these bots work alongside humans during welding and machining tasks. The world of spare parts is changing fast too thanks to additive manufacturing. We're seeing around 12% of all aftermarket inventory made up of 3D-printed parts now across different industries, which means getting replacement pieces for older machinery isn't taking nearly as long as it used to. Some recent research from last year found that factories using both old school CNC machines and modern metal 3D printing tech together cut down on wasted materials by roughly 37% over what was possible with just traditional approaches alone.

Case Study: Caterpillar’s Digital Factory and Automation Strategy

One manufacturer reduced prototype development cycles from 14 weeks to 6 through digital twin simulations. Their fully automated hydraulic cylinder line achieves 99.96% precision by integrating vision systems with machine learning algorithms. This approach decreased warranty claims related to manufacturing defects by 41% in two years.

Scaling Innovation Without Disrupting Legacy Manufacturing Lines

Companies balance modernization with continuity through modular upgrades—63% retain core mechanical systems while adding smart sensors and connectivity layers. Phased implementation strategies allow manufacturers to test AI-driven predictive maintenance tools on select product lines before full-scale adoption, maintaining production stability during transitions.

Transparency and Trust in OEM-Supplier Collaborations

Growing Demand for Visibility Across Manufacturing Processes

The way heavy equipment gets made these days depends a lot on clear communication channels between original equipment manufacturers and their suppliers. According to that latest Supplier Collaboration Report from 2024, around three quarters of construction machine makers want instant access to supplier information so they can keep tabs on parts quality and when those components actually arrive. Cloud based ERP systems have become pretty common across the industry, helping different companies see what's going on without all the usual headaches. And let's face it, this kind of transparency cuts down on those annoying procurement holdups by somewhere between 12 to maybe even 18 days for each project, as noted in an article from Industrial IoT Journal back in 2023.

The Role of Suppliers in Driving Innovation and Reliability

Strategic suppliers contribute 34% of patented technologies in machinery hydraulics and drivetrain systems, per a 2024 Heavy Equipment Innovation Study. Leading manufacturers implement joint R&D programs with suppliers to:

- Co-develop corrosion-resistant alloys for mining equipment

- Integrate predictive maintenance sensors into component designs

- Standardize testing protocols across global supply networks

Case Study: Kubota’s Regional Partnership Model with Distributors

Kubota reduced lead times by 22% in North America by restructuring its supplier network around regional hubs. The company established:

| Strategy | Outcome |

|---|---|

| Localized parts warehouses | 48-hour fulfillment for 90% of components |

| Shared maintenance diagnostics | 15% fewer warranty claims |

| Joint inventory planning committees | $2.8M annual logistics savings |

This proximity-driven approach cut equipment downtime by 1,200 hours annually while strengthening distributor relationships through transparent demand forecasting.

Maximizing Equipment Longevity and Total Value of Ownership

Total Cost of Ownership vs. Equipment Service Life

When looking at total cost of ownership (TCO), folks need to weigh what they spend initially against all those ongoing expenses down the road such as maintenance, how much fuel something burns, and when it breaks down completely. Take mining excavators for instance. Those big machines that last around 15 years actually end up costing about 18 percent less per ton moved compared to shorter-lived ones lasting only 8 to 10 years even though they cost more when first purchased according to Walia Group research from last year. And interestingly enough, operators who focus on TCO rather than just trying to save money right away tend to deal with roughly 32 percent fewer unexpected repairs throughout ten whole years of operation.

Designing for Low Maintenance and Extended Durability

Manufacturers now integrate wear-resistant alloys and modular components to reduce part replacement cycles by 40–60%. Sealed hydraulic systems and corrosion-proof coatings extend service intervals by 300–500 operating hours, directly lowering lifecycle costs.

Case Study: Komatsu’s High-Lifespan Excavators in Mining

A leading manufacturer’s 300-ton mining excavators achieved 28,000 hours of operation without major overhauls—45% above industry averages—through advanced load-sensing hydraulics and AI-driven lubrication systems.

Ownership vs. Rental Trends in Modern Construction Projects

Ownership remains preferred for high-utilization equipment (1,500+ annual hours), with owned assets delivering 22% lower TCO than rentals in infrastructure projects. However, 63% of contractors now rent specialized machinery used under 300 hours/year to avoid storage and depreciation costs.

Smart Technology’s Role in Extending Machine Lifespan

Predictive maintenance systems using IoT sensors reduce component failures by 57% by analyzing vibration, temperature, and oil quality data. According to a 2024 efficiency study, integrating digital twins with maintenance workflows extends drivetrain lifespans by 3–5 years in quarry equipment.

FAQ Section

What is the significance of ISO 3449 standards in the heavy equipment industry?

ISO 3449 standards set safety measures that have contributed to reducing worksite deaths by about a third, promoting enhanced safety in the heavy equipment industry.

How have modular design approaches impacted the heavy equipment industry?

Modular design approaches allow for the upgrading of parts without replacing entire machines, saving money and minimizing downtime.

What are some common failure points in heavy machinery?

Common failure points include hydraulic leaks, structural fatigue problems, and worn-out bearings.

How does total cost of ownership (TCO) affect equipment service life?

TCO requires balancing initial spending with long-term expenses. Machines with a longer lifespan often have a lower TCO when weighing operational costs over time.

Table of Contents

- Three Decades of Industry Evolution and Trusted Expertise

- Engineering Reliability: Designing Durable and Fail-Safe Machinery

- Digital Transformation Reshaping Heavy Equipment Manufacturing

- Transparency and Trust in OEM-Supplier Collaborations

- Maximizing Equipment Longevity and Total Value of Ownership